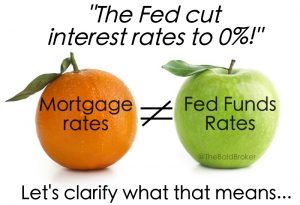

It is true that the Federal Reserve (“the Fed”) cut interest rates to 0%. First I’ll start by explaining what the federal funds rate actually is. The federal funds rate is the rate at which banks lend money to other banks from their reserve balances on an overnight basis. The federal funds rate is also a benchmark on several different types of consumer debt.

However, the Fed rate cut does not have any direct correlation on fixed-rate mortgages. This rate cut only directly impact short term and variable-rate debt such as adjustable-rate mortgages, HELOCs, and credit cards, and it will also lower interest rates on savings accounts.

Due to the economic fallout from the coronavirus, the goal of this rate cut by the Fed is to stimulate the US economy by making access to money cheaper for the American consumer. Additionally, the Fed launched a quantitative easing initiative where $700 billion in government and mortgage-related bonds will be purchased in order to bolster the economy and help battle the effects that the coronavirus has had on financial markets.

In summary, the Fed rate cut does not mean fixed-mortgage rates will go down, nor does it mean fixed-rate mortgages are now at 0%. Ultimately, we may see a dip in mortgage rates in the coming days and weeks, but it is too soon to tell how the Fed rate cuts will play a role.

In summary: Are interest rates still good? Yes! Are interest rates at 0%? No, they are not. Will rates go down in the coming weeks? Maybe, but it is too soon to tell.

If you have any questions about your specific situation or about anything mortgage-related, please feel free to email me at dan@solcostahomeloans.com or call/text 707-297-5656.

Dan Patty

Mortgage Broker/Owner

Solcosta Home Loans

NMLS 1266702